Why choose us for e-invoicing in KSA?

Seamless Integration

التكامل السلس

Seamless integration with ERP's

التكامل السلس مع تخطيط موارد المؤسسات

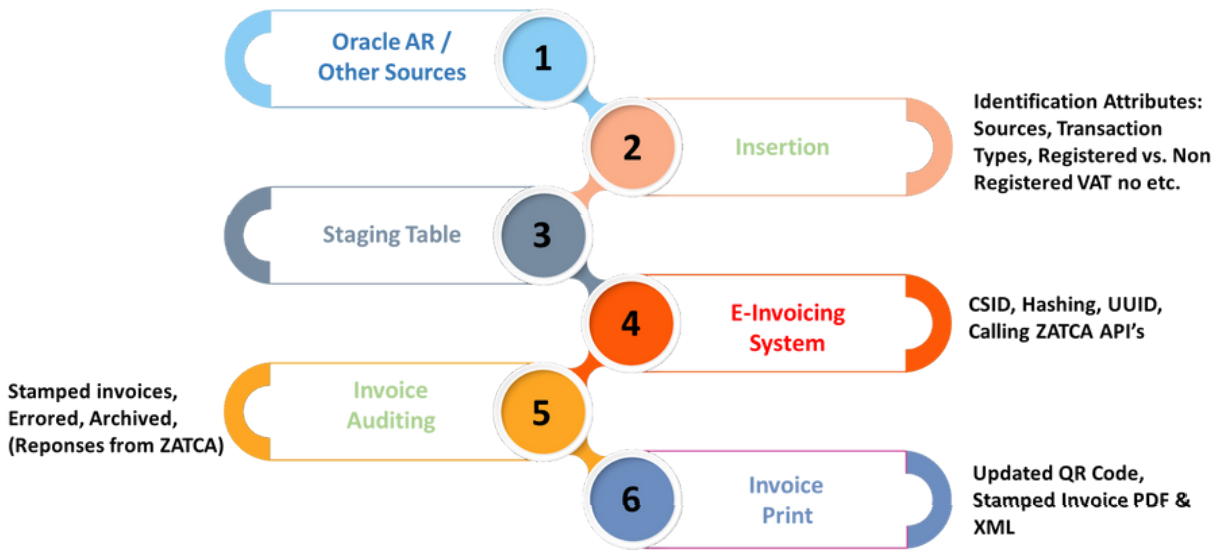

Bulk Generation of UUID

الجيل الأكبر من UUID

Bulk Upload and Generation of UUID

تحميل بالجملة وتوليد UUID

Data Validation

التحقق من صحة البيانات

Multiple auto validation of data to ensure 100% compliance of law

التحقق التلقائي المتعدد للبيانات لضمان الامتثال 100٪ للقانون

Cost-Effective

فعاله من حيث التكلفه

Reduced Cost of Operations

انخفاض تكلفة العمليات

Data Security

أمن البيانات

Desktop-based solution with 100% data security with real-time monitoring

حل قائم على سطح المكتب مع أمان بيانات بنسبة 100٪ مع مراقبة في الوقت الفعلي

Support Team

فريق الدعم

Assistance in Resolving queries

المساعدة في حل الاستفسارات